Imagine converting your retirement savings into a steady, reliable income — one that starts precisely when you need it and lasts as long as you choose. That’s precisely what an annuity payout is designed to do. But how much you get, when you get it, and how long it lasts depends heavily on the kind of annuity you choose, your payout option, and a range of personal and market factors. In this article, we’ll break down how annuity payouts work, the key types of payout options, what influences the size of your payout, and the trade-offs involved — so you can make informed decisions for your retirement.

✅ What Is an Annuity Payout?

An annuity payout (or “settlement”) refers to the stream of payments you receive from an annuity after you’ve entered the payout phase. In simpler terms: you pay a lump sum (or series of payments) into the annuity, and in return, the insurer agrees to pay you back over time — either for a fixed term or for your lifetime.

These payments can begin immediately (for an immediate annuity) or be deferred to a later date (in a deferred annuity).

✅ Types of Annuity Payouts

Fixed vs. Variable Payouts

- Fixed payout annuity: You receive a guaranteed, constant amount each payment period. Your insurer promises a fixed sum, regardless of market performance.

- Variable payout annuity: Your payments fluctuate, because they depend on how the underlying investments (like mutual funds) perform.

- There are also indexed annuities, where payouts link to a market index but may have floors and caps to limit downside risk.

✅ Timing and Duration of Payouts

When Payouts Start

- With immediate annuities, payments begin almost right away — typically within a month of your lump-sum purchase.

- With deferred annuities, there’s an accumulation phase, and payouts commence later — sometimes years after the premium is paid.

How Long Payouts Last

Your annuity payout length hinges on the payout option you choose:

- Life (Single-Life): Payments continue for as long as you live.

- Life with Period Certain: You get payments for your lifetime and a guaranteed minimum period (e.g., 10 years). If you die before that period ends, your beneficiaries continue to receive payments.

- Joint & Survivor: Payments continue for your life, then for your spouse’s life (or both, depending on the option).

- Fixed Term / Period Certain: Payments for a defined number of years (say, 10, 20, or 30), regardless of life span.

- Lump Sum: You can sometimes opt to receive your annuity value as a one-time payment (though this often results in a lower overall return or different tax treatment).

✅ What Determines the Size of Your Annuity Payout

Several factors influence how big your annuity payout will be:

- Premium Amount: The more you invest, the higher your potential payouts.

- Start Date / Age: If you begin payouts later, there are fewer expected payments — which typically means higher individual payouts.

- Life Expectancy / Mortality Assumptions: Insurers use actuarial models; longer expected lifespan usually means lower monthly payouts.

- Payout Option: As noted, life-only gives more per payment than joint or period-certain options because of the trade-off in guarantees.

- Interest Rates: Current rates play a big role — higher rates generally increase payout amounts, as insurers can invest premiums more profitably.

- Riders and Guarantees: Adding features like minimum payout guarantee, death benefits, or inflation adjustments can reduce the base payout.

✅ How Payouts Are Calculated

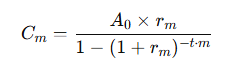

Annuitization (turning the account value into regular payouts) typically involves actuarial mathematics. One common formula (for a fixed, immediate annuity) is:

- (Cm) = payment per period (e.g., monthly)

- (A0) = present value (how much you paid in)

- (rm) = nominal rate per payment period

- (m) = number of payments per year

- (t) = total number of years of payout

For life annuities and more complex payout options, insurers use actuarial present value methods that adjust for mortality risk, discount factors, and payment frequency.

✅ Pros and Trade-Offs of Different Payout Options

Advantages of a Larger, Simpler Payout

- Higher income: Life-only payouts are typically the largest, as there’s no guarantee period or return-of-principal rider.

- Simplicity: Less complexity, fewer riders, and fewer administrative complications.

Trade-Offs / Disadvantages

- Risk to heirs: If you choose a life-only option and pass away early, there may be no remaining balance for beneficiaries.

- Less flexibility: Once payouts begin, it’s hard to change the structure or get money out without penalties.

- Inflation risk: Fixed payouts may lose real value over time unless there is an inflation rider.

- Cost of guarantees: Options like joint life, period certain, or death benefits reduce monthly payouts.

✅ When a Payout Annuity Makes Sense

- You want steady, predictable income in retirement, especially if you’re worried about outliving your savings.

- You prefer security over growth: A fixed payout gives you stability, even in market downturns.

- You have limited need for inheritance: If leaving a large estate is not your priority, simpler life-only options may work well.

- You want customization: Using riders, you can tailor your payout — for example, to include your spouse, guarantee payment years, or ensure a death benefit.

✅ Risks and Considerations

- Surrender Periods: Before the payout phase, annuities often have a surrender period — withdrawing money early can incur steep penalties.

- Credit Risk: Your payout depends on the insurer’s financial strength.

- Illiquidity: Once you annuitize, accessing large chunks of the capital becomes difficult.

- Complexity: Not every payout option is easy to understand; mistakes or misunderstandings can be costly.

- Cost of Features: Riders and guarantees may meaningfully reduce your regular payout in exchange for protection or flexibility.

✅ Conclusion

An annuity payout can be a powerful way to convert your retirement savings into a reliable income stream. Depending on your choices — fixed vs. variable, life vs. term, immediate vs. deferred — your payments can vary widely in amount, duration, and risk. While life-only options offer higher monthly checks, more flexible or guaranteed variants (joint-survivor, period-certain) trade a bit of income for added security or legacy benefits. Understanding how payouts are calculated, what influences them, and which trade-offs fit your financial goals is critical. Used wisely, an annuity payout can give you peace of mind and financial stability throughout your retirement.

✅ FAQs

- What is the “annuitization phase”?

It’s the phase when you start receiving your annuity payout — converting your saved-up value into periodic payments.

- Can I change my payout option later?

Generally, not. Once you select how the annuity will pay out (life, period certain, joint, etc.), it’s difficult to change without major restructuring or penalties.

- Does gender affect my payout?

Yes. Because life expectancy differs, insurers often offer different payout rates for men and women.

- Will my payouts stop someday?

That depends on the option. With a life-only annuity, payments stop when you die. With a period-certain option, payments continue for a minimum fixed number of years, even if you pass away.

- Is a variable annuity payout riskier?

Yes — a variable annuity payout can go up or down depending on how the underlying investments perform.

- How do inflation-linked annuity payouts work?

If you choose an inflation-indexed annuity, payouts increase over time based on a specified inflation measure (or index), helping preserve your purchasing power.

Related Topics: Annuity Payout Calculator, Annuity, Annuity Calculator