| Period | Starting Balance | Contribution | Interest Earned | Ending Balance |

|---|

Related Useful Calculator

Retirement Savings

A Retirement Savings Calculator is a tool that helps us figure out how...

Retirement Withdrawal

A Retirement Withdrawal Calculator is a tool that helps us plan how...

Annuity Payout Calculator

Calculate accurate monthly annuity payouts with...

✅ What is an annuity?

An annuity is a contract between you (the contract owner/annuitant) and an insurance company, where you make premium payments (either a lump sum or over time) and the insurer promises to pay you (or your beneficiary) income either immediately or at a future date.

✅ What is the accumulation phase of an annuity?

The accumulation phase is the period during which you fund the annuity (via premiums or a lump sum) and the contract’s value grows (tax-deferred) until the payout or annuitization phase begins.

✅ Does every annuity have an accumulation phase?

No. Only deferred annuities have an accumulation phase. Immediate annuities begin payouts right away (or almost immediately) and thus skip (or have no meaningful) accumulation phase.

✅ What happens to the money/growth during the accumulation phase?

During accumulation the premiums and any returns on them accrue in the annuity contract. The growth is typically tax-deferred (i.e., you don’t pay income tax on earnings until you withdraw). Depending on the type (fixed, variable, indexed), the growth may be via a guaranteed rate or via investment performance.

✅ Can I withdraw money during the accumulation phase, and are there penalties?

Yes, you can withdraw or surrender the contract during the accumulation phase, but often there are surrender charges (fees) and if you’re under certain age thresholds (e.g., < 59½ in the U.S.) you may have tax penalties. Withdrawing too early can reduce your growth potential significantly.

✅ What factors affect how much an annuity grows during the accumulation phase?

Key factors include the size and timing of your premium contributions, the length of the accumulation period (longer is generally better), the type of annuity (fixed rate vs variable vs indexed), the fees and charges inside the contract, and for airable/indexed types, the performance of the underlying investments or index.

✅ What happens if I die during the accumulation phase?

If you die during the accumulation phase, the contract typically includes a death benefit: either the current contract value (accumulated amount) or a guaranteed minimum (e.g., premiums paid) will go to your beneficiary, depending on the terms.

✅ How is the accumulation period different from the payout (annuitization) period?

The accumulation period is when you’re funding the annuity and growing its value. The payout (annuitization) period is when you begin receiving payments from the contract (either a lump sum or regular income). The transition from accumulation to payout is a key structural shift in how the contract works.

✅ Is the growth during accumulation taxed immediately?

No — the earnings (interest, investment returns) during the accumulation phase are generally tax-deferred (you don’t pay taxes on them while they remain in the contract). Taxes are due when you begin taking distributions or withdrawals.

✅ What are the main risks or pitfalls during the accumulation phase I should watch for?

Main risks include: paying high fees or surrender charges that erode growth; withdrawing prematurely which triggers fees/taxes and reduces compounding; choosing too short an accumulation period (so insufficient growth before income begins); selecting a product whose investment component underperforms (for variable/indexed types); and inadequate liquidity (money tied up when you might need access).

✅ What is an Annuity Calculator?

An annuity calculator is a financial tool that helps you estimate the future value of your annuity during the accumulation phase. By entering details such as your initial investment, regular contributions, interest rate, and number of years, it calculates how much your annuity will grow over time — including total contributions, interest earned, and future value.

✅ What is the Accumulation Phase of an Annuity?

The accumulation phase is the period when you’re building up the value of your annuity through contributions and investment growth. It continues until you begin receiving payments (the payout phase). During this time, your earnings grow tax-deferred, meaning you won’t pay taxes until you start withdrawals.

✅ What Are the Characteristics of Our Annuity Calculator?

Your annuity calculator includes:

- Initial Investment Input: Start-up capital or lump-sum contribution.

- Regular Contribution Options: Monthly, quarterly, or annual payments.

- Expected Return Rate (%): Annual growth rate of the annuity.

- Flexible Duration: Choose your desired investment period (in years).

- Future Value Output: The projected total value at the end of accumulation.

- Breakdown Visualization: Clear pie chart showing contribution vs. interest earned.

- Schedule Table: Displays the growth of your investment per period.

✅ How Do You Use Our Annuity Calculator?

Using the calculator is simple:

- Enter your initial investment amount.

- Add your regular contribution (e.g., monthly deposit).

- Select your contribution frequency.

- Input the expected annual return rate (interest).

- Choose the number of years you plan to invest.

- Click “Calculate.” The calculator instantly displays the future value, total contributions, interest earned, and a visual breakdown chart.

✅ Who Uses Annuity Calculators?

Annuity calculators are used by:

- Investors and retirees planning for future income.

- Financial advisors estimating long-term growth for clients.

- Insurance agents explaining accumulation projections.

Students and researchers studying financial modelling.

Essentially, anyone planning for retirement or future financial security benefits from it.

✅ Why Should You Use an Annuity Calculator?

You should use an annuity calculator to:

- Estimate your potential savings before the payout phase.

- Compare different investment durations and interest rates.

- See how regular contributions impact long-term growth.

- Plan your retirement income goals with real numbers.

It helps make informed financial decisions and visualize how consistent investing pays off over time.

✅ What Inputs Affect the Accumulation Results Most?

The most influential factors are:

- The amount and frequency of contributions.

- The interest rate or expected return.

- The length of the accumulation period. Even small changes in these inputs can significantly impact your future value due to compounding growth.

✅ What Is the Formula Used in an Annuity Calculator?

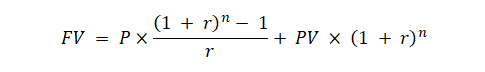

Most calculators (like yours) use the future value of an ordinary annuity formula:

Where:

- (FV) = Future value of the annuity

- (P) = Regular payment amount

- (r) = Periodic interest rate

- (n) = Total number of periods

- (PV) = Present (initial) value

✅ What Is the Difference Between Ordinary and Annuity Due in the Calculator?

- Ordinary Annuity: Payments are made at the end of each period.

- Annuity Due: Payments are made at the beginning of each period. Your calculator allows users to select between the two, which changes how compounding interest is calculated.

✅ How Reliable Are the Results of an Annuity Calculator?

- An annuity calculator provides accurate estimates based on the data entered, assuming consistent returns and contributions. However, real-world factors like market fluctuations, tax implications, and fees may slightly alter the actual outcome. It’s best used as a planning and comparison tool, not an exact prediction.